A cloud disaster recovery plan is vital for Startups and SMEs, as it safeguards critical data, minimizing the risk of permanent loss during unexpected events or system failures.

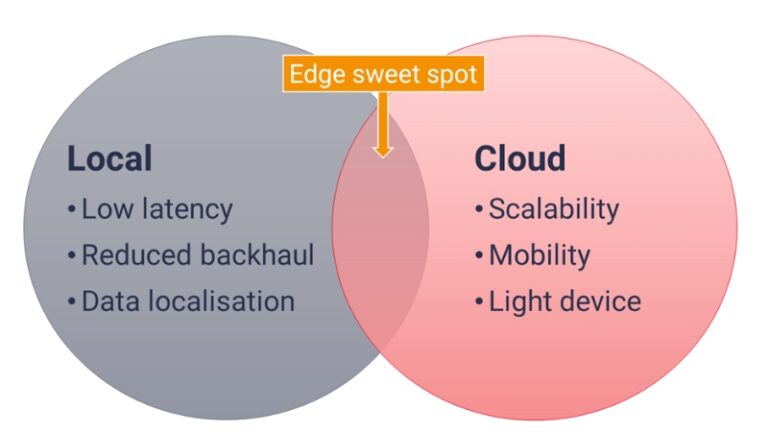

In today's digital age, companies of all sizes depend on technology for everyday operations. The introduction of cloud computing has completely altered how companies manage their data. The flexibility and cheap fixed costs of cloud computing make it particularly attractive for startups and SMEs. However, the danger of data loss and downtime due to system failures, cyber-attacks, or unforeseen events has grown, along with the rising dependency on technology. Here's when your disaster recovery and business continuity strategies come in handy.

What is Cloud Computing and why a Cloud Disaster Recovery Plan is required?#

Let us first have a recap of what Cloud Computing means...

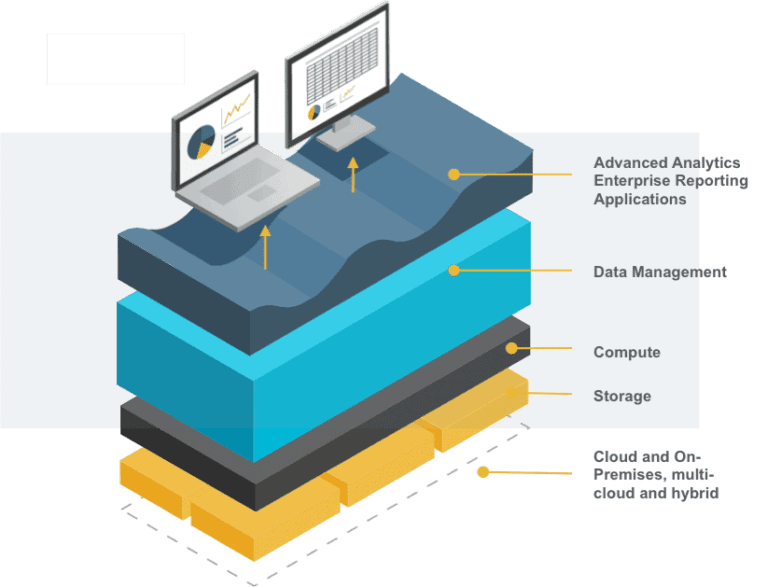

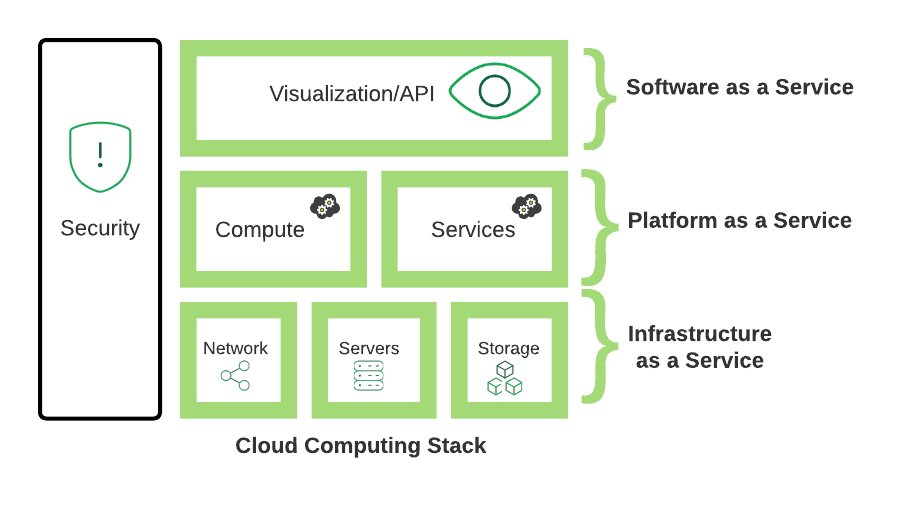

"Cloud computing" refers to delivering data center resources such as servers, storage, databases, software, analytics, and intelligence to users remotely through the internet.

It allows companies to get these services on demand without buying expensive servers and other software. Infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS) are just some of the services from cloud computing companies.

Many businesses implement disaster recovery in cloud computing to ensure the safety of data in any incident.

Let us now have a detailed look at the benefits provided by cloud computing and how startups and SMEs can leverage it.

Benefits of Cloud Computing for Startups and SMEs#

The use of cloud computing has several advantages for small and medium-sized businesses. Also, business continuity and disaster recovery in cloud computing are necessary which we will discuss further.

Cost-effectiveness:

The use of cloud computing has helped small and medium-sized businesses (SMBs) by removing the financial burden of purchasing and installing costly hardware and software infrastructure.

Scalability:

Small and medium-sized businesses (SMEs) may easily modify or expand their operations as needed.

Accessibility:

Cloud computing allows organizations to access their data and apps from any location with an internet connection.

Data Security:

Cloud service providers secure their customers' data from hackers and other online threats using advanced security protocols, including encryption and firewalls.

What is Business Continuity Planning?#

Business continuity planning is a process that includes finding possible threats to a business's operations and making a plan that minimizes the effect of these threats on the business. This process usually involves figuring out the most important business functions, coming up with plans to make sure these functions can keep going even if there is a breakdown, and trying these plans to ensure they work.

A solid cloud disaster recovery plan is essential for company continuity and minimizing downtime during unexpected interruptions.

Why Startups and SMEs Need Business Continuity#

Compared to bigger companies, startups, and SMEs often need more resources and infrastructure to deal effectively with disruptions. These companies may take a major impact in the form of financial loss, damaged image, and even bankruptcy if they experience a single downfall. Some examples of why small and medium-sized businesses (SMEs) require business continuity:

- To Ensure Business Survival

- To Mitigate Risks

- To Protect Reputations

Disaster Recovery Plan#

Disaster recovery in cloud computing is an essential component of business continuity planning. A business's disaster recovery plan is an in-depth plan outlining the steps that must be taken in the case of catastrophic events to restore the company's essential IT infrastructure, software, and data.

Whether natural (such as floods, hurricanes, and earthquakes) or man-made (such as cyber-attacks and system failures), incidents may strike at any moment and for various reasons. Organizations need to have a disaster recovery in cloud computing to guarantee that they can swiftly and easily restore their mission-critical information technology (IT) infrastructure and data in the event of a catastrophe, therefore mitigating the damage to their operations, reputation, and bottom line.

A disaster recovery plan typically includes the following components:

1. Risk Assessment:#

A comprehensive evaluation of the potential hazards that may lead to interruptions in the organization's IT infrastructure and information.

2. Recovery Time Objective (RTO):#

Determining the duration the organization can tolerate the unavailability of its essential IT systems and information.

3. Recovery Point Objective (RPO):#

A well-defined establishment of the timeframe within which the organization must restore its data, ensuring that the information is as current as feasible.

4. Backup Strategy:#

A comprehensive strategy for routinely backing up essential IT systems, applications, and data, guaranteeing a swift and efficient recovery of the information in case of a catastrophe.

5. Recovery Strategy:#

A comprehensive plan describes the measures and protocols the organization must adhere to recover its essential IT systems and information in the event of a calamity.

6. Communication Plan:#

A strategy for effectively communicating with stakeholders, including employees and customers, during and after a catastrophe.

7. Testing and Maintenance:#

A strategy for periodically testing and maintaining the disaster recovery plan to ensure that it is current and efficient.

8. DRaas:#

Disaster recovery as a service (DRaaS) is essential for business as it provides a flexible and cost-effective solution to the business. Disaster recovery as a service enables automated backup, replication, and recovery of essential systems and data to ensure business continuity.

Benefits of a Cloud Disaster Recovery Plan#

As expected, a cloud disaster recovery plan lays out potential outcomes to minimize interruptions in service and quickly restart normal operations following an unfortunate event. Data loss prevention and adequate IT recovery should be prioritized as part of its design because of their critical role in the business continuity strategy.

The most obvious advantage of having a cloud disaster recovery plan is that it ensures the firm's operations will continue regardless of the conditions.

Cost-efficiency

Disaster recovery in cloud computing includes several components that can enhance cost-effectivenesses, such as prevention, detection, and correction. Organizations can reduce the risks associated with artificial disasters by implementing preventative measures. Detection measures enable rapid identification of issues when they occur, while corrective measures facilitate the restoration of lost data and a prompt resumption of operations.

Regular maintenance of IT systems and comprehensive analysis of potential threats are essential to achieve cost-efficiency objectives. Innovative cybersecurity solutions should also be implemented. Ensuring that software is up-to-date and systems are optimally maintained saves time and reduces costs.

In addition, incorporating cloud-based data management into a disaster recovery plan can further decrease the costs of backups and maintenance.

Increased productivity

To enhance the effectiveness and productivity of your team in disaster recovery planning, it is crucial to assign specific roles and responsibilities and establish accountability. This approach also guarantees redundancy in personnel for critical tasks, which improves productivity in case of sick days and minimizes turnover costs.

Improved customer retention

In the competitive market, customers have high expectations and are less likely to forgive an organization for failures or downtime, particularly if it results in losing sensitive data. Planning Business continuity and disaster recovery in cloud computing is crucial to meet and maintain a high standard of service in all circumstances.

By minimizing the risks of data loss and downtime for your customers, you can ensure that they receive superior service during and after a disaster, strengthening their loyalty to your organization.

Compliance

Enterprises, financial markets, healthcare patients, and government entities heavily depend on critical organizations' availability, uptime, and disaster recovery plans. Moreover, these organizations rely on disaster recovery plans to comply with industry regulations such as HIPAA and FINRA.

Scalability

Disaster recovery planning helps businesses to discover innovative solutions to minimize the expenses associated with archive maintenance, backups, and recovery. Implementing cloud-based data storage and related technologies simplifies and improves the process, providing additional flexibility and scalability. Moreover, the disaster recovery planning process helps reduce the risk of human error, eliminates unnecessary hardware, and streamlines the entire IT process.

Also, business continuity and disaster recovery in cloud computing become an advantage of disaster recovery planning by optimizing the business operations and making them more resilient and profitable, even before any disaster occurs.

Conclusion#

The small business owners need business continuity and disaster recovery plans to secure their data from unforeseen circumstances. Companies may protect their essential data, reduce the damage caused by interruptions, and maintain business operations by using a cloud-based disaster recovery strategy. The cloud's scalability, cost-efficiency, and ease of use make it a great option for small and medium-sized enterprises (SMEs) wishing to implement disaster recovery plans.

A disaster recovery plan may ensure that companies can continue running even if a disaster disrupts their regular operations. Having a robust disaster recovery plan that includes risk assessment, backup, and recovery plans, and communication protocols, ensures a company can continue operating even in unforeseen circumstances. If you are a startup or SME, cloud disaster recovery plan solutions offer advantages such as cost-efficiency, enhanced security, increased productivity, improved customer retention, and regulatory compliance.

FAQs#

1. What is a disaster recovery plan, and why is it essential for businesses?

A disaster recovery plan outlines a business's approach to recovering IT infrastructure, applications, and data after an incident like a natural disaster or cyberattack. It is essential for minimizing downtime, protecting data, and ensuring business continuity.

2. How does cloud computing benefit startups and SMEs in disaster recovery?

Cloud computing offers cost-effective, scalable, and accessible solutions that enhance disaster recovery capabilities. It provides robust data security, regular backups, and quick recovery options, making it ideal for startups and SMEs with limited resources.

3. What are the key components of a disaster recovery plan?

Key components include risk assessment, recovery time and point objectives, backup strategy, recovery strategy, communication plan, testing and maintenance, and, if applicable, Disaster Recovery as a Service (DRaaS).

4. How can a cloud disaster recovery plan improve customer retention?

By ensuring minimal downtime and maintaining data security during a disaster, businesses can provide consistent and reliable services, thereby improving customer trust and retention.

5. Why is regular testing and maintenance important for a disaster recovery plan?

Regular testing and maintenance ensure the disaster recovery plan remains effective and up-to-date, addressing any new risks and ensuring all components function as intended during an actual disaster.

Discover more on how our innovative solutions can provide peace of mind and enhance your business continuity planning. Contact us today to learn more about our cloud disaster recovery plans tailored for startups and SMEs.